The construction sector has absorbed the cost shock early, then faced the rate shock late — creating a two-wave insolvency cycle that continues to delay recovery.

An industry perspective from BEA Insurance Brokers

Construction businesses don’t experience inflation the way most sectors do. They absorb energy inflation early, face insurance repricing alongside it, and then encounter interest rate pain late — a sequencing that leaves margins exposed long before monetary policy reacts. This isn’t just part of the normal economic cycle. It’s the way construction is exposed to inflation and monetary policy.

The first shock typically arrives through energy. Construction is one of the most energy – intensive parts of the economy. Long before inflation shows up in headline CPI figures, builders are already paying more for the essentials that make a project possible: cement, steel, aluminium, glass, freight, plant hire, and fuel. When energy costs rise, suppliers don’t wait for CPI confirmation. Prices move immediately, often through “temporary” surcharges that quietly become permanent.

By the time inflation is officially recognised, construction costs have already reset higher. Builders know this instinctively because they see it in quotes and purchase orders well before it becomes a headline.

Unlike many other industries, construction has limited ability to adjust quickly. Retailers can reprice weekly. Service providers can modify fees. Manufacturers can change product mix. Builders can’t. Fixed-price contracts and long project durations mean that when costs rise mid-project, the builder absorbs the increase in real time. There is often no practical way to pass it on.

What many construction businesses don’t expect is that insurance often follows almost immediately. Insurance doesn’t wait for CPI either. In fact, it often moves earlier than headline inflation because insurers price based on expected future replacement cost, not last year’s averages. When energy costs rise, the cost to repair or rebuild rises with it. Materials, labour, transport, plant hire and time on site all increase. Insurers respond by repricing premiums around what they expect claims to cost in the coming year.

The impact is not theoretical. Claims inflation becomes visible quickly. Even minor incidents become expensive. Water damage, temporary works, site security, fire repairs and delay costs all climb sharply in an environment of rising construction costs. Insurers react because loss severity rises across the entire portfolio.

At the same time, underwriting appetite often tightens. In periods of rapid construction inflation, insurers tend to become more cautious. Excesses rise. Limits tighten. Policy terms become less forgiving. Builders can find themselves facing higher premiums not only because their sums insured have increased, but because the insurer’s confidence in the sector’s stability has declined.

This is where the industry sees a frustrating mismatch: inflation may not yet feel widespread, but insurance premiums are already climbing. The reason is simple. CPI is a lagging indicator. Insurance pricing is forward-looking.

Then, just as businesses begin adjusting to higher input costs and higher insurance costs, the second hit arrives. Last week’s interest rate rise was a reminder that construction businesses often feel the full force of monetary tightening long after the original cost shocks have already flowed through the supply chain.

Interest rate increases are typically a delayed response. By the time the Reserve Bank begins tightening, construction businesses have already absorbed the early impacts of energy-driven inflation and insurance repricing. Projects are already committed. Materials are already purchased. Contracts are already signed.

Interest rates then hit through a different channel entirely. Funding costs increase. Developers reassess feasibility. Purchasers step back. Approval pipelines slow. Working capital becomes harder to access. The builder who has already carried cost increases now faces a tightening market with less tolerance for margin recovery.

This is why construction ends up wearing the worst timing of any major sector. It absorbs inflation early, but suffers the demand shock late.

And when inflation finally begins to ease, construction businesses rarely see the relief they expect. Costs tend not to reverse. Labour resets upward and rarely unwinds. Supplier pricing resets become the new baseline. Compliance, contract administration and risk management costs increase permanently. Insurance premiums, once repriced upward, often do not fall back in line with CPI. Inflation may slow, but the cost base remains structurally higher.

For many in construction, this is the most difficult part to accept. The inflation surge is treated as temporary. The commercial reality is permanent.

Construction doesn’t cause inflation. It absorbs it.

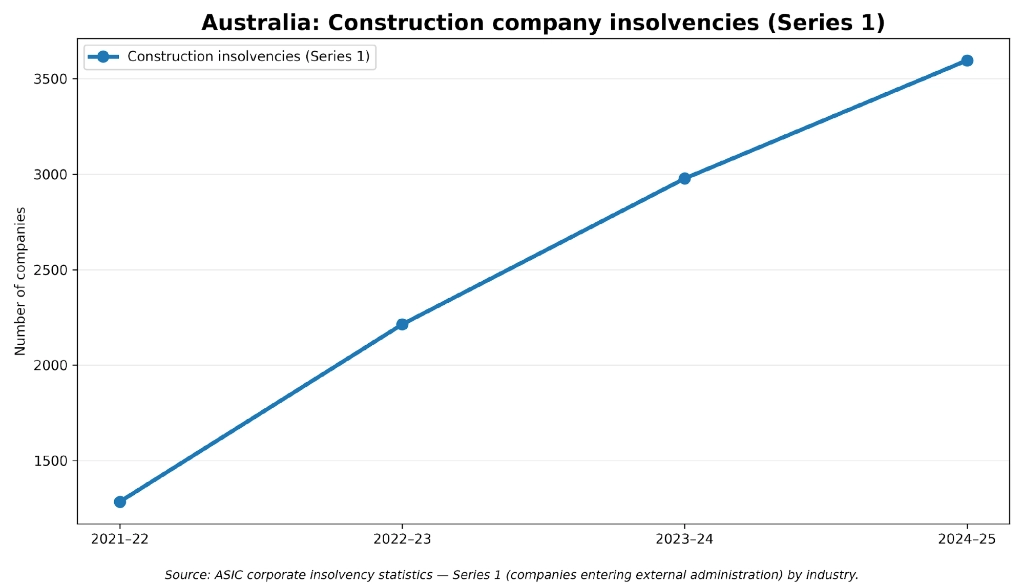

Figure: Construction company insolvencies (ASIC Series 1)

- Early inflation rise

- Early insurance rise

- Later interest rate rise

That combination explains much of what the industry has experienced over the last few years — and why resilience now depends as much on risk management and insurance strategy as it does on winning the next job.

This article was prepared by BEA Insurance Brokers — a specialist construction insurance brokerage supporting builders and construction businesses across Australia.